The cash price for my family of five to fly to Japan and stay for 12 nights? $14,000. By using credit card points and miles, our total cost? Just $5,800 — and the best part? You can plan Travel to Japan on points just like this.

In this step-by-step guide, I’ll show you exactly how we’re planning a family trip to Japan using points for both flights and hotels. From the best travel credit cards to maximizing rewards programs like Aeroplan and Hyatt, I’ll walk you through every detail — so you can copy our flights and hotels strategy and turn your dream trip into a reality.

The Challenge of Traveling to Japan with a Family of 5 — Solved with Points

Japan has been on our family’s travel wishlist for years. But traveling during peak season with a family of five — me, my wife, and our three kids — adds up quickly. Flights from Toronto alone were pricing out at around $1,800 each round-trip for a reasonable itinerary (nonstop or 1 stop each way). That’s $9,000 just to get there and back.

Hotels? Easily another $5,000 for a mix of mid-range family-friendly accommodations in Osaka and Tokyo for two weeks.

Total: $14,000+ for flights and hotels.

Luckily, using points, makes this trip easier on the wallet.

Flights to Japan: How I’m Booking 5 Seats with Aeroplan Points

Disclaimer: Aeroplan redemption rates can change at any time. The pricing I’m sharing is based on award availability and rates I’ve seen at the time of writing and over the past year. While this is a realistic redemption, it’s always possible that the required points could increase in the future.

Instead of paying $9,000 in cash for roundtrip flights, I’m using Aeroplan points to book one-way flights from Toronto to Japan, and paying cash for the return flights.

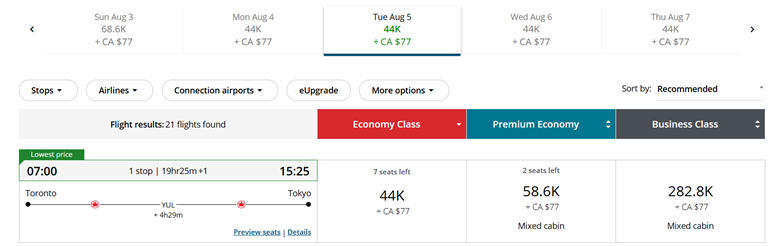

One of the best-value Aeroplan redemptions I’ve found — with solid availability at the time of writing — is a one-way flight from Toronto to Tokyo for 44,000 Aeroplan points plus about $77 CAD in taxes and fees (per person). This price is for an Air Canada-operated flight and falls on the lower end of their dynamic pricing range.

Aeroplan uses dynamic pricing for Air Canada flights, which means the number of points required can fluctuate significantly. While redemptions between 44,000 and 50,000 points are fairly common, it’s not unusual to see wild spikes — sometimes as high as 126,000 points for the exact same route and class. In cases like that, you’re much better off either waiting for dynamic prices to come back down, or booking with a partner airline instead.

Partner redemptions (such as with ANA or other Star Alliance carriers) follow a fixed chart — typically 50,000 points one-way in economy — though they usually come with higher taxes and fees. These can still offer great value, especially when Air Canada’s pricing goes off the rails.

To see how pricing is determined, refer to the Aeroplan Flight Reward Chart and check the section labeled “Between North America and Pacific zones.”

Using tools like Roame.Travel (my go-to) definitely helps find the best redemptions.

Real Value: How Much Are You Saving with Points?

So, what is the price of booking 5 flights to Tokyo from Toronto? 220,000 points + $385 in taxes/fees, at the time of writing.

For the return trip, we plan to fly Zipair from Tokyo to Vancouver, which prices out to about $700 per person. Then we will fly direct from YVR to YYZ with a number of carrier options for about $200 per person. Total return trip works out to $900 x 5 seats = $4,500.

So:

- $385 ($77 x 5 seats) for taxes and fees for the Aeroplan flight redemptions (Toronto to Tokyo)

- $4,500 cash one-way return (Tokyo to Vancouver to Toronto)

- Total cost: $4,885 + points vs $9,000 retail for roundtrip cash fare

- Savings: $4,115

- $4,115 / 220,000 points –> That works out to about 1.87 cents of value per Aeroplan point (cpp) — which is a solid return for economy redemptions.

This Aeroplan redemption is one of the best value ways to fly to Japan on points — especially if you’re booking for a family.

How You Can Earn the Points to Fly to Japan on Rewards

I’ve already earned the Aeroplan points for this trip. But if you’re starting from scratch, this section is for you.

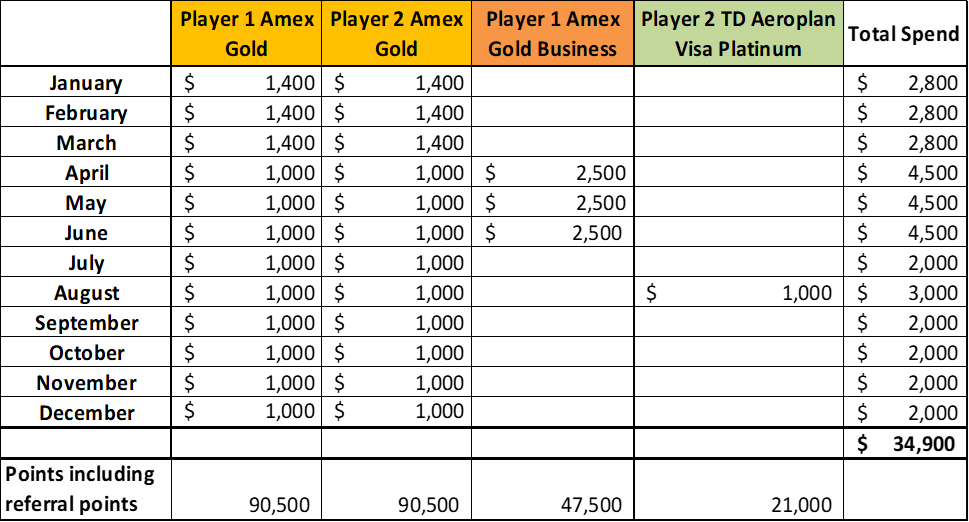

Here’s a 2-player setup (you + a partner) that will get you over 250,000 Aeroplan points — enough to book 5 one-way flights like I plan to.

Step-By-Step Credit Card Strategy:

1. Amex Gold Personal (x2) – For Player 1 and Player 2

- Earn 5,000 points each month when you spend $1,000 for 12 months → 60,000 points

- Earn 10,000 points if you spend $4,000 in the first 3 months (inclusive of the above spend requirement)

- Since you will spend $13,000 in the above spend requirements, you will also get at least 13,000 points

- Total of 83,000 points earned!

- Points transfer 1:1 to Aeroplan

- Net cost to earn the signup bonus:

- $250 annual fee for 1st year

- $100 in total perks value (annual travel credit)

- Net cost = $150

- Can cancel after the 12-month fee posts within 30 days if you find you don’t get ongoing value for the card (transfer your points first!)

- Apply Here

- Player 1 applies first using a referral link, which offers the highest bonus. Once Player 1 is approved, Player 2 applies using Player 1’s referral link.

- Each player earns 83,000 points after spending $13,000 over 12 months. Be sure to review the specific terms and minimum spend requirements, as offers may change.

- Player 1 also earns a 7,500-point referral bonus from Player 2’s application.

- Transfer Amex MR Points to Aeroplan Points 1:1

- The annual fee, which is charged at initiation, is $250, but it comes with a $100 annual travel credit, effectively making the net annual fee $150. After the second annual fee is charged at the 12-month mark, if you find the card doesn’t offer ongoing value, you can cancel within 30 days and receive a refund. So for both players, the net annual fee totals $300 (2 x $150).

2. Amex Business Gold – For Player 1

- Spend $7,500 in 3 months → Earn 40,000 bonus points + 7,500 from spend = 47,500 total

- Annual fee: $199 (Year 1) – Application below will get you $125 rebate when GCR offers it

- Net cost: $74 after rebate

- You must let the second $199 fee post to receive full bonus

- Cancel within 30 days of second fee being charged to get the refunded, if you don’t find ongoing value in the card

- Apply Here (Receive a $125 rebate if you apply with GCR)

- Consider applying for this card about 3 months after getting the Amex Gold Personal, or when you know you’ll have elevated expenses that can help you meet the minimum spend requirement.

- Referral bonus: 7,500 points

- Transfer Amex MR Points to Aeroplan Points 1:1

- The $199 annual fee is due at initiation. After the 12-month renewal fee posts, if you find the card doesn’t offer ongoing value, you can cancel within 30 days to receive a refund.

3. TD Aeroplan Visa Platinum – For Player 2

- Spend $1,000 in 90 days → Earn 20,000 points

- You cannot earn this bonus if you have earned the bonus from the CIBC Aeroplan® Visa* Card

- Annual fee: $89 (first year waived)

- If you don’t find ongoing value in the card, you can cancel it before the 24-month mark to avoid a second annual fee. You may be able to cancel the card shortly after the 12-month period and before the 13th month to get the $89 12-month waived, effectively not paying any annual fees.

- Apply Here

- Consider this card after player 1 has already met the spending requirement for the Amex Business Gold to make your combined spending easier.

- First year annual fee waived

Points Earned:

- 83,000 points from Amex Gold earned by Player 1

- 83,000 points from Amex Gold earned by Player 2

- 47,500 points from Amex Gold Business earned by Player 1

- 21,000 points from TD Aeroplan Visa Platinum earned by Player 2

Referral Bonuses:

- 7,500 points to Player 1 (from Player 2’s Amex Gold app)

- 7,500 points to Player 2 (from referring Amex Biz Gold)

Total: 249,500 points — and that’s assuming just 1x points per dollar on spend. With some 2x categories, you’ll likely go over. That is more than the 220,000 required for 5 seats using the redemption above for Toronto to Japan.

Total Cost Breakdown for Flights

Assuming you follow the card strategy outlined above and earn the bonus points as described, here’s what your out-of-pocket costs and total savings could look like for this flight redemption and the cash price returning from Japan.

| Item | Cost |

| Points cost for 5 one-way flights (44,000 each) | 220,000 points |

| Aeroplan taxes/fees | $385 ($77 x 5 seats) |

| One-way cash return (Tokyo to Toronto) for 5 seats | $4,500 |

| Credit card fees ($150 Net for the Amex Gold x 2 + $199 for the Amex Gold Business) | $500 |

| Total Cost | $5,385 |

| Retail Price | $9,000 |

| Total Savings | $3,615 |

How to Meet Minimum Spend Requirements to Earn Points for a Trip to Japan

By using your regular monthly expenses strategically, you can meet the minimum spending requirements on these credit cards over the course of a year. Here’s an example of how your monthly spending on each card could look to earn enough points for your trip:

Considering the total minimum spend required across the cards is $34,900, and the savings from flights alone is $3,615 (using 220,000 points). Plus say, ~30,000 points left over (valued at $420 assuming 1.4 cents per point of value), you are getting $4,035 of value — that’s a 11.6% return on your spending.

Using Hyatt & Marriott Points for a Family Stay in Osaka, Tokyo & Mt. Fuji

For 13 nights in Japan, the cash cost for hotels is around ~$5,000.

Instead, we plan to use Chase Ultimate Rewards points transferred to Hyatt + Marriott Bonvoy points or free night certificates to cover our stays. Note that you do need to book these stays early, perhaps 9-10 months ahead (fully cancellable), as these redemptions are in high demand.

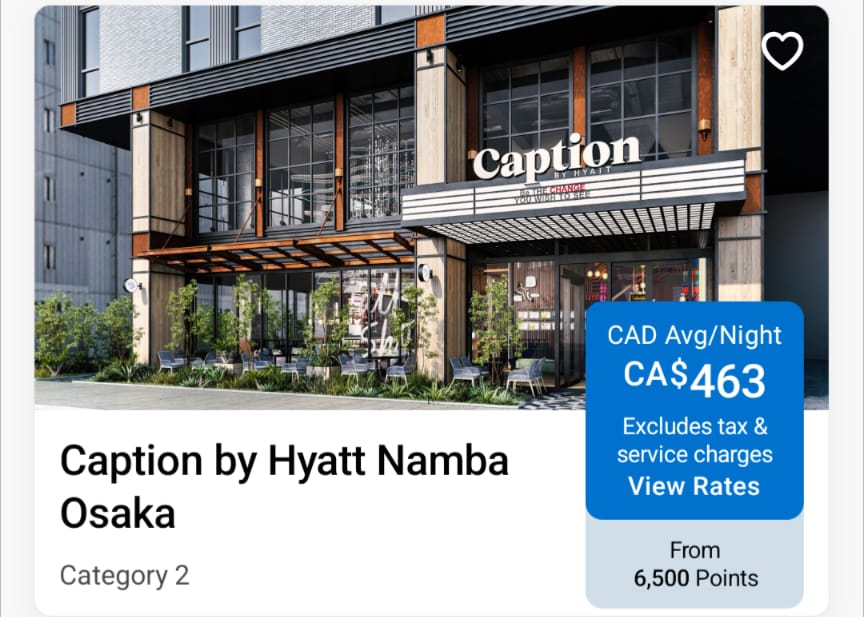

- Caption by Hyatt Osaka: 6 nights x ~6,500 points = 39,000 points

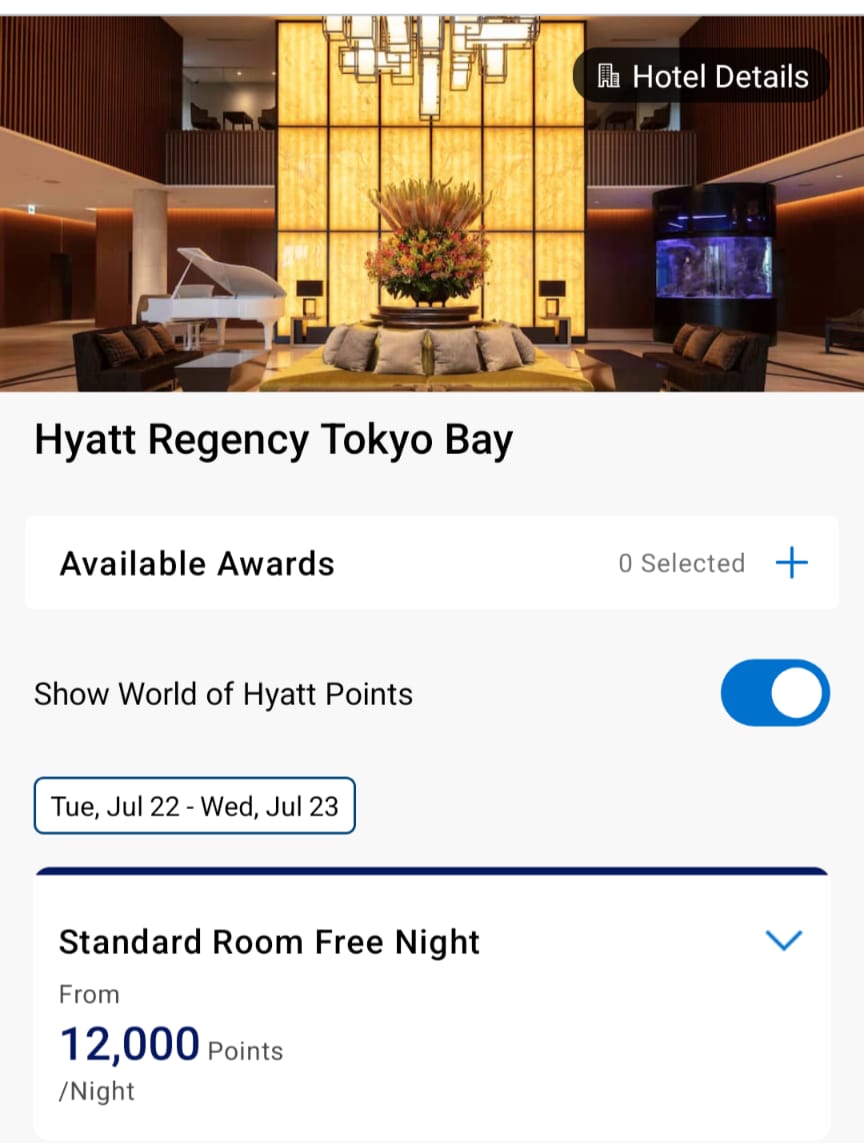

- Hyatt Regency Yokohama: 5 nights x 12,000 points = 60,000 points

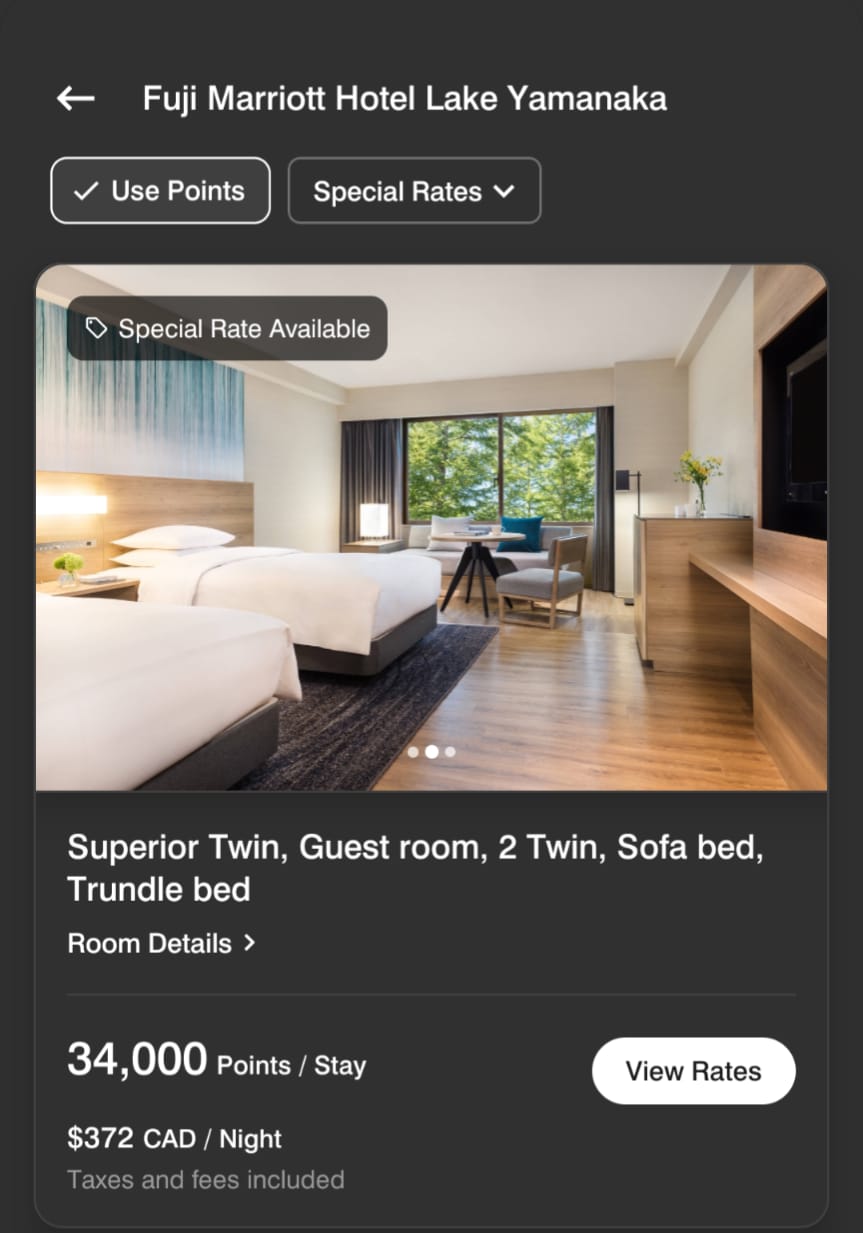

- Fuji Marriott Hotel Lake Yamanaka: 2 nights x 34,000 = 68,000 (or two free night certificates from Amex Bonvoy cards)

Savings: $5,000 using points — with only ~$407 in annual card fees (as described below).

How You Can Earn Points for Free Hotel Stays Too

I’m using Chase points earned from U.S. cards (if you are Canadian, you can get U.S. cards — it’s easier than you think — Here’s a great guide from Frugal Flyer on how to get U.S. credit cards as a Canadian), and Marriot Bonvoy free night certificates. Here are the cards that can get you the same benefits:

Chase Sapphire Preferred (U.S) (current limited-time offer):

- Normally offers 60,000 points, but now offering 100,000 bonus points for a limited time after spending $3,000 USD in 3 months

- Chase Ultimate Rewards points transfer 1:1 to Hyatt

- Points stretch very far with Hyatt’s award chart

- With the 100,000 points, you can book 6–9 nights at Hyatt properties depending on the location and category.

- Annual Fee: $137 USD (converted from $95 USD)

Chase Ink Business Preferred (U.S.) (additional option for Chase points):

- Earn 90,000 Chase Ultimate Rewards after spending $8,000 USD in 3 months

- Yes, it’s a hefty minimum spend, but if you can meet it with regular expenses, these points can be worth $3,000–$4,000 CAD in value when transferred to Hyatt

- Apply Here

- Annual Fee: $137 USD (converted from $95 USD)

Amex Bonvoy (Canada)

- Best offer is through a referral link like the one below

- Instant Silver Elite Status

- Spend $3,000 in 3 months → Earn 65,000 points (ends August 18, 2025)

- Free night certificate every year up to 35,000 points starting on the first anniversary (~$350 value)

- Annual fee: $120

- Apply Here

Amex Bonvoy Business (Canada)

- Best offer is through a referral link like the one below

- Instant Silver Elite Status

- Spend $6,000 in 3 months → Earn 75,000 points (ends August 18, 2025)

- Free night certificate every year up to 35,000 points starting on the first anniversary (~$350 value)

- Annual fee: $150

- Apply Here

Learn more about the Amex Bonvoy cards.

Points Travel to Japan: Flights + Hotels Cost vs. Cash

Here’s the total savings breakdown from this plan — including both flights and hotels — based on realistic redemptions and the net credit card fees incurred along the way. It’s an example of what points can unlock.

| Category | Cash Price | Cost | Savings |

| Flights | $9,000 | $5,385* | $3,615 |

| Hotels | $5,000 | $407** | $4,593 |

| Total | $14,000 | $5,792 | $8,208 |

*Includes: Flights, credit card fees (2x Amex Gold + 1 Amex Gold Business), taxes and fees

**Hotel Credit Card fees:

- Amex Bonvoy Personal: $120 CAD

- Amex Bonvoy Business: $150 CAD

- Chase Sapphire Preferred: $137 USD (converted from $95 USD)

That’s 58% savings using a points strategy earned from regular expenses, after all applicable taxes and fees, credit card fees, etc.

Summary: How You Can Book the Same Trip

- Follow the 2-player credit card strategy outlined above

- Stack sign-up bonuses with referral links

- Use Aeroplan for flight redemptions

- Earn Chase points with Chase credit cards and transfer to Hyatt for hotels

- Use Amex Bonvoy cards for Free Night certificates

- Be flexible on dates and use search tools: Roame.travel, Aeroplan search tool, Hyatt calendar view

With a little planning, this trip is 100% within reach — even if you’re starting today.

Final Thoughts: This Trip is Possible for You Too

I know how overwhelming points travel can seem at first. But this trip to Japan is the result of using a system — not a fluke.

It’s not about spending a ton or being a credit card hacker. It’s about using the right cards, planning ahead, and maximizing value.

Want to Do This Too? Here’s What to Do Next

- Review how many points you’ll need for this trip or a similar one and consider the credit cards you need from the strategy above.

- DM me if you want help planning your own trip or understanding how to get started.

Let’s get you on a plane to Japan — for a whole lot less.

Disclaimer: This is not financial advice or professional financial planning. I’m simply sharing an example of how I’m planning a trip using credit card points and strategies that have worked for me. Always do your own research to ensure any approach suits your personal situation. This post may also contain referral links, which help support the blog at no additional cost to you.