Ensure you read [What You Really Need to Know About Credit Card Offers] before implementing this strategy and opening credit cards.

Want Points Fast? These Are the Cards to Get

Here’s the cheat code: Credit card signup bonuses are by far the fastest way to rack up travel points—without flying millions of miles or spending a fortune. In this section, I’ll show you exactly how to unlock massive value through a 1- or 2-player system designed to fit your lifestyle and spending habits.

⚠️ Transparency note: Some of the links in this post may be referral links, which means I could receive a small commission if you apply through them. I only include links to cards that I personally use and strongly believe are worth it for the signup bonus. These are the best available offers at the time of writing, whether they’re referral links or not. If you’ve found this guide helpful, using my links is a free way to support the content and keep it coming.

1-Player Strategy: Two Lanes (~$3,000 monthly spend)

Value Breakdown of 1-Player Mode

If you are earning points solo, with a monthly spend of around $3,000 that you can put on credit cards, you can earn more than 350,000 points which can be worth more than $5,000 to $7,000 in economy flights or $18,000 or more in business class flights while paying net annual fees (annual fee – card perks) of $873. Here’s a breakdown of the cards that can earn you Aeroplan points efficiently with signup bonuses:

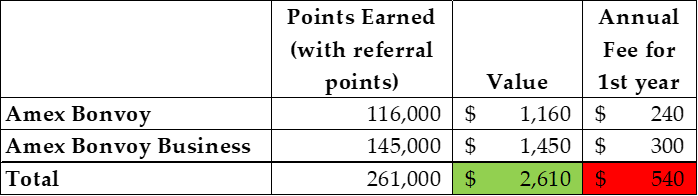

You can also earn Marriott Bonvoy points from Amex Bonvoy cards, which outweigh the first year’s annual fees. To take the most advantage, these cards are worth keeping for their free annual night certificate and saving points to top off those certificates each year. Read more about that here.

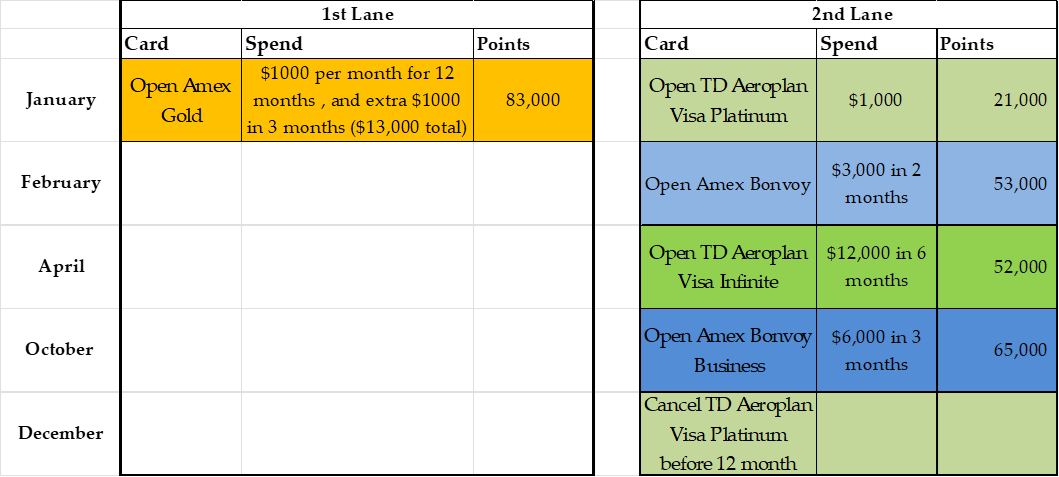

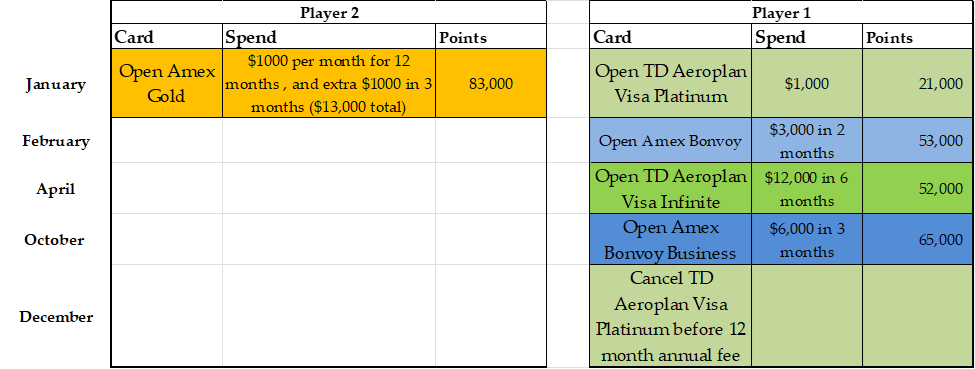

1-Player Schedule: Earn Points Fast and Efficiently

You’ll use a 2-lane system: one long-term card for steady spend, and a rotating lane of fast MSRs (Minimum Spend Requirements) to rack up points quickly without overwhelming your budget.

Lane 1: Long-Term Card

Use the Amex Gold since it’s a longer MSR and put $1,000/month of consistent spending on it.

Lane 2: Short-Term Cards

While Lane 1 runs in the background, rotate through cards with smaller, quicker MSRs:

- TD Aeroplan Visa Platinum

- Amex Bonvoy (Personal or Business)

- TD Aeroplan Visa Infinite

- Amex Business Gold

- Amex Platinum (timed for large expenses)

It’s like running a marathon (Lane 1) while doing short sprints (Lane 2). You’ll earn consistently without burning out.

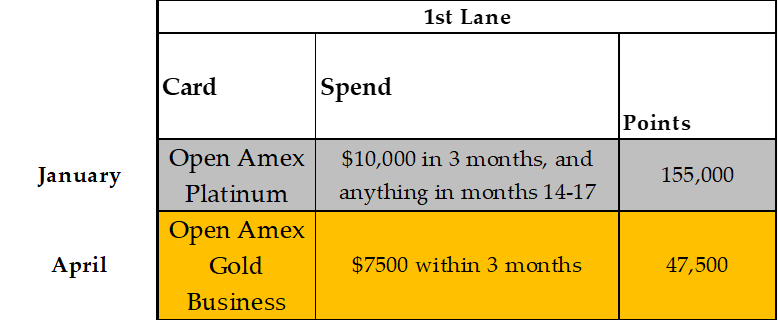

1st-Year

2nd-Year

Assuming you can get the elevated bonus for the Amex Platinum, open this card when you have a major expense or extra required spending. Ensure you understand the benefits of this card and can take advantage of them to offset the annual fee.

Remember, you need to spend anything in months 14-17 to get the entire bonus for the Amex Platinum. Also, this assumes you get the elevated offer of the Amex Platinum. We don’t know for sure if that offer will come back but hoping that becomes available around the end of the year.

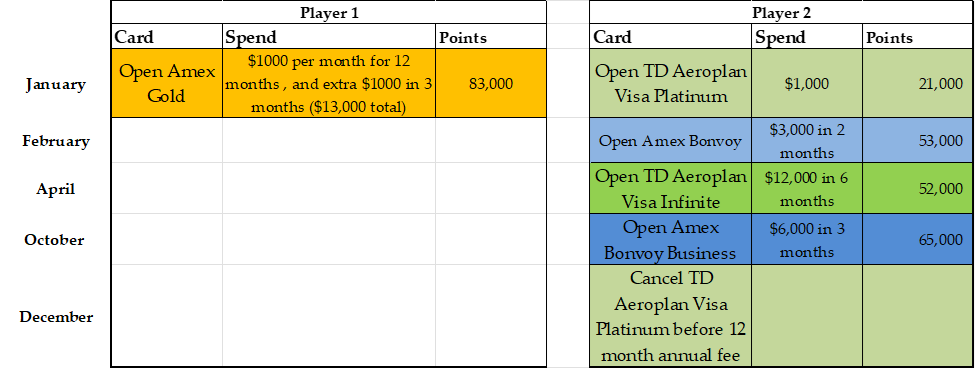

2-Player Mode (Double the Points)

Double your impact. With a partner in points, you can scale up twice as fast—thanks to referral bonuses and coordinated spending. For Amex cards, the 2nd person who gets the same card will use the 1st person’s referral link so that the 1st person gets points as a referral bonus.

Value Breakdown of 2-Player Mode

What 1 Million Points Gets You (2-Player Strategy)

Wondering what a million points actually buys you?

- $2,600+ in hotel stays via Bonvoy

- $10,598+ in economy flights

- $37,850+ in business class value

- Use your points right, and the rewards can be massive. This isn’t just travel—it’s luxury on points.

Goal: Use referrals + teamwork to scale your points faster using the same spend.

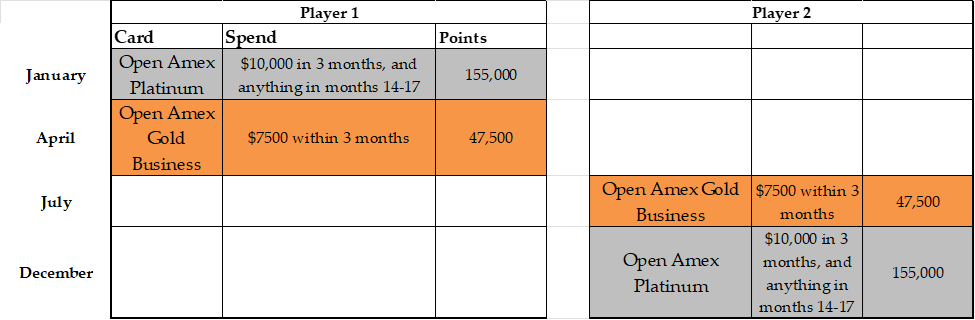

2-Player Schedule

- Each player runs their own 2-lane setup.

- Use referral links for Amex cards so the first player earns bonus points when referring the second.

- Flip roles in Year 2.

- Get the Amex Platinum and Amex Business Gold for each player.

1st-Year

Year-2

Do the same thing as Year 1 but switch the players around. When opening Amex cards, use the referral link of the player who got the card first to ensure that player collects referral bonus points.

Year 3 schedule

Excel Credit Card Tracker

Here’s a simple excel sheet to track credit card spending based on the schedules above. Modify it to fit your needs and whatever schedule you will ultimately use.

Alternative Strategy: Slow & Steady

If you don’t want to open multiple cards, consider just the Amex Cobalt (5x points on groceries, dining, and food delivery) → Hint: you can even buy gift cards at grocery stores to get 5x the points.

The Cards in Detail

1. TD Aeroplan Visa Platinum

- Spend $1,000 in 90 days → Earn 20,000 points

- You cannot earn this bonus if you have earned the bonus from the CIBC Aeroplan® Visa* Card

- Annual fee: $89 (first year waived)

- If you don’t find ongoing value in the card, you can cancel it before the 24-month mark to avoid a second annual fee. You may be able to cancel the card shortly after the 12-month period and before the 13th month to get the $89 12-month waived, effectively not paying any annual fees.

- Apply Here

2. Amex Bonvoy

- Best offer is through a referral link like the one below

- Instant Silver Elite Status

- Spend $3,000 in 3 months → Earn 65,000 points (ends August 18, 2025)

- Free night certificate every year up to 35,000 points starting on the first anniversary (~$350 value)

- Annual fee: $120

- Apply Here

3. Amex Bonvoy Business

- Best offer is through a referral link

- Spend $5,000 in 3 months → Earn 65,000 points

- Free night certificate every year up to 35,000 points starting on the first anniversary (~$350 value)

- Annual fee: $150

- Keep this card for the annual free night

- Apply Here

4. TD Aeroplan Visa Infinite

- Spend $12,000 total in 12 months → Earn 52,000 points (40,000 bonus + 12,000 from spending)

- You cannot earn the bonus from this card if you have earned the bonus from the CIBC Aeroplan® Visa Infinite* Card or the Amex Aeroplan card

- Breakdown: $7,500 in first 6 months + $4,500 total in the next 6 months (total of $12,000 in 12 months)

- Annual fee: $139 (often waived Year 1)

- Includes free checked bags for up to 8 passengers on Air Canada flights

- If you don’t see long-term value in the card, consider cancelling before the 24-month mark to avoid paying a second annual fee

- Apply Here

5. American Express Gold Card

- Earn 5,000 points each month when you spend $1,000 for 12 months → 60,000 points

- Earn 10,000 points if you spend $4,000 in the first 3 months (inclusive of the above spend requirement)

- Since you will spend $13,000 in the above spend requirements, you will also get at least 13,000 points

- Total of 83,000 points earned!

- Points transfer 1:1 to Aeroplan

- Net cost to earn the signup bonus:

- $250 annual fee for 1st year

- $100 in total perks value (annual travel credit)

- Net cost = $150

- Can cancel after the 12-month fee posts within 30 days if you find you don’t get ongoing value for the card (transfer your points first!)

- Apply Here

6. Amex Business Gold Card

- Spend $7,500 in 3 months → Earn 40,000 bonus points + 7,500 from spend = 47,500 total

- Annual fee: $199 (Year 1) – Application below will get you $125 rebate when GCR offers it

- Net cost: $74 after rebate

- You must let the second $199 fee post to receive full bonus

- Cancel within 30 days of second fee being charged to get the refunded, if you don’t find ongoing value in the card

- Apply Here (Receive a $125 rebate if you apply with GCR)

7. American Express Platinum

- Best offer is usually available through referral links—apply when the elevated offer is live (look for 140,000–145,000 point offers) and when you have a major upcoming expense.

- Spend $10,000 in 3 months → Earn 100,000 points (when elevated)

- Make a purchase between months 14–17 → Earn another 10,000–30,000 points

- Total bonus: Up to 155,000 points

- Annual fees: $799 (Year 1) + $799 (Year 2) = $1,598

- Perks each year:

- $200 dining credit

- $200 travel credit

- Amex Offers (~$100+)

- Priority security at major Canadian airports

- Access to Centurion, Priority Pass, and Plaza Premium lounges

- Marriott Bonvoy Gold Elite status

- Net cost after perks: ~$598

- Cancel before the third year if the card no longer adds value

- Worth it? If you maximize the perks and sign up during an elevated offer window, the points alone can be worth over $2,200 in economy flights or ~$8,000 in business class flights—making this a top-tier card for luxury travel and serious point collectors.

- Note: You may be ineligible for the Amex Gold Personal signup bonus if you get the Amex Platinum first. So, if you plan on getting both cards, start with the Gold, then get the Platinum afterwards.

- Apply Here

Final Thoughts

Credit card signup bonuses are hands-down the fastest way to rack up serious travel rewards in Canada. Whether you’re booking a weekend getaway or a roundtrip flight to Europe, playing the points game right can unlock huge savings on both economy and premium travel.

Just remember:

- Always pay your balance in full and on time—no exceptions.

- Apply for cards strategically and don’t rush your applications.

- Use your regular monthly expenses to meet MSRs—no need to overspend.

- Leverage referral bonuses and 2-player mode to accelerate your points.

- Don’t hoard points! Programs devalue over time—redeem while they’re still hot.

You don’t need to follow this guide to the letter. Build a strategy that works for your spending habits and travel goals. Yes, it takes some effort, maybe even a spreadsheet or two—but whether it’s $500 off your next family trip or $30,000 in dream vacations, the payoff can absolutely be worth it.

This isn’t a get-rich-quick scheme. But it is a get-free-travel-with-a-little-strategy kind of deal.

Ready to stop paying full price for travel? This is your sign.

🛫 Your dream trip is closer than you think.

If you have any questions or want help crafting your own points strategy, feel free to shoot me an email at Mike @ pointswithmike.com or connect with me on Instagram @PointsWithMike

Related: Best Credit Card Offers This Month in Canada – Travel Rewards