Overview of The BMO VIPorter Credit Cards

Porter Airlines is now the third Canadian airline to enter the co-branded travel credit card space, following Air Canada and WestJet. The BMO VIPorter Mastercard and BMO VIPorter World Elite Mastercard are designed specifically for those who fly Porter, in my opinion, offers the best economy experience in the skies today. They earn VIPorter points (Porter’s frequent flyer currency) and offer travel perks like free bags, seat selection, and companion passes.

- Cards: BMO VIPorter Mastercard & BMO VIPorter World Elite Mastercard

- Best For: Porter flyers, especially those on the East Coast or with families

- Annual Fees: $89 (base), $199 (World Elite), both waived in Year 1

- Signup Bonuses: Up to 40,000 or 70,000 VIPorter points, depending on the card + 10,000 point waitlist bonus if applicable

Porter Airlines is now a true competitor in the travel rewards space, giving Canadians more options beyond Aeroplan and WestJet.

What Are VIPorter Points Worth — And How Do They Work?

VIPorter points can only be redeemed for Porter-operated flights — there are no airline or hotel partners. However, Porter now flies coast-to-coast in Canada and to several U.S. cities.

From my use and research, VIPorter points are worth about 1.5 cents per point (cpp). For context, Aeroplan averages ~1.5 cpp, and Marriott Bonvoy points around 1.0 cpp. So while Porter’s network is smaller, the point value is competitive.

If you’re already flying Porter, the points are easy to use and stretch pretty far — especially during peak travel seasons.

What’s It Like Flying with Porter Airlines?

This is really where Porter shines. Even if you’re flying economy, it feels a step above. You still get complimentary wine, beer, and snacks — which makes a big difference on a longer flight. Some airports even have their boutique-style lounges, and the cabins themselves are clean and modern.

In my experience, the service has always been genuinely friendly, which adds to the whole “not-your-average-economy” vibe. I’m also a fan of Porter’s new Embraer E195-E2 jets. They’re surprisingly quiet — thanks to newer engines and noise-dampening tech — and the ride feels more like a calm commute than a typical commercial flight.

Travel Perks and Benefits of the BMO VIPorter Credit Cards

One of the most unique things about these cards — and something you won’t find with Aeroplan or WestJet cards — is that they’re the only co-branded airline credit cards in Canada that grant automatic VIPorter status. That means benefits like priority check-in and early boarding come baked in, no status chasing required.

Shared Benefits (Both Cards)

Whether you choose the base card or the World Elite, you’ll get VIPorter Avid Traveller status, which includes early boarding, priority check-in, and no points expiry — ideal for casual travelers who don’t fly often enough to earn status the hard way. You’re also covered with a solid set of travel insurance protections: emergency medical coverage abroad, lost or delayed baggage, car rental insurance, and even hotel burglary protection. These are perks that you’d usually expect from higher-tier cards, so it’s a nice surprise to see them included here.

Base Card Perks (BMO VIPorter Mastercard)

If you go with the base version of the card, there’s a particularly interesting perk: once you spend $25,000 in a year, you unlock a 35% discount on the base fare of Porter flights. It’s a nice incentive if you regularly book travel for yourself or others, but the spend requirement is a bit high for most casual users. Still, with the first year’s annual fee waived, this version of the card is a relatively low-risk way to get a taste of the perks.

World Elite Perks (BMO VIPorter World Elite Mastercard)

The World Elite version takes things further — and is especially valuable for families or people who book travel for groups. You get free seat selection and free checked and carry-on baggage for up to eight people traveling on the same reservation. If you’ve ever paid for seat selection or checked bags, you know how quickly those fees add up — this perk alone could save you hundreds per trip.

You’re also upgraded to VIPorter Venture status, which is a step above the base card’s Avid Traveller level. On top of that, the World Elite comes with trip cancellation, delay, and interruption insurance, which can come in handy if your travel plans ever go sideways.

And if you’re a big spender? Hitting $50,000 in annual card spend unlocks a 100% base fare companion pass, which can easily cover the cost of another flight each year. That’s a stretch goal for most, but for someone using the card for everyday business or family expenses, it’s a potentially valuable bonus.

Welcome Bonuses: What You Get in Year One

Both BMO VIPorter cards come with tiered welcome bonuses, meaning you unlock points gradually as you reach certain spending milestones. It’s not one big lump sum — but if you plan your spending across the year, these bonuses can add up to solid first-year value, especially with the annual fee waived.

BMO VIPorter Mastercard

- 10,000 points when you spend $3,000 within the first 110 days

- 15,000 points after spending an additional $3,000 by day 180

- 15,000 more points after another $4,000 in spend by the end of your first year

- Total: 40,000 points on $10,000 spend (~4% return)

For someone looking to ease into the program, this base card offers a decent entry point. It spreads out the bonus across three stages, which can feel manageable — especially if you’re using the card for regular household expenses.

BMO VIPorter World Elite Mastercard

- 20,000 points on $5,000 spend within 110 days

- 20,000 points on another $4,000 by day 180

- Additionally, by spending $9,000 by day 180 you will receive a companion flight pass good for 1 year which gives you 100% off the base fare

- 30,000 points on an additional $9,000 by day 365

- Total: 70,000 points on $18,000 spend (~5.8% return)

The World Elite version offers a higher bonus, but also requires more spend to unlock it. That said, even if you only complete the first two tiers, you’re still getting 40,000 points on $9,000 spend — which is where I personally stopped. Unless you’re a high spender, the third tier might not be worth chasing.

How to Earn VIPorter Points from Everyday Spending

Beyond the signup bonus, both cards offer respectable earn rates on your day-to-day purchases — especially if you tend to spend in categories like groceries, gas, and travel.

BMO VIPorter Mastercard

- 2x points on Porter purchases (plus 6x more from Avid Traveller Passport status)

- 1x point per dollar on gas, public transit, groceries, dining, and hotels

- 0.5x on all other purchases

BMO VIPorter World Elite Mastercard

- 3x points on Porter purchases (plus 6x more from Venture status)

- 2x points on gas, transit, groceries, dining, and hotels

- 1x on everything else

While the earn rates might not beat top-tier rewards cards like the Amex Cobalt, they’re still competitive — especially if you’re planning to fly Porter regularly and can stack your everyday purchases to rack up points faster.

Personalized Value: BMO VIPorter Points Calculator

Now that you’ve seen the potential value you would get from these cards in the first year, how much value would you get every year after the first year while considering the annual fee? Use this calculator to input your monthly spending on travel, groceries, gas, and more, and see your potential annual return based on your spending habits. Based on a point value of 1.5 cents.

VIPorter Points Calculator

BMO VIPorter Mastercard

BMO VIPorter Mastercard

BMO VIPorter World Elite

BMO VIPorter World Elite

Note: This calculator doesn’t include every perk these cards offer — some benefits like priority boarding or seat selection are harder to quantify and may hold different value depending on your travel habits.

BMO VIPorter Credit Cards: Pros and Cons

Like most co-branded airline cards, these come with solid perks — but only if they align with how (and where) you travel. Here’s what stands out — and where the cards fall a bit short:

Pros

- Generous signup bonuses — especially in the first year with no annual fee, making it a low-risk way to try the card

- Real savings for families or groups — perks like free seat selection and checked bags for up to 8 people can add up fast

- Solid earn rates — 3x on Porter flights and up to 2x on everyday categories like groceries and gas help you earn points without changing your spending habits

Cons

- High spend required for top-tier perks — unlocking the companion pass or 35% discount requires $25K–$50K in annual spend, which won’t be realistic for everyone

- No flexibility with points — unlike Aeroplan or Amex MR, VIPorter points can’t be transferred or used for hotels, upgrades, or other airlines

- Limited route network — Porter’s growing, but it still doesn’t match the reach of bigger airlines, especially for international flights

These cards work best when you already fly Porter — or plan to start — and can realistically take advantage of the perks. If you’re looking for flexible rewards or international reach, another card might suit you better.

Who Should Consider Getting One of These Cards?

These cards aren’t for everyone — but if you fall into the right group, they can deliver excellent value.

A Good Fit If You…

- Live in a Porter hub city like Toronto, Ottawa, Halifax, or Montreal — places where Porter operates frequent and convenient routes

- Travel as a family or group — perks like free seat selection and baggage for up to eight people are where the savings really stack up

- Appreciate comfort and convenience over flash — things like early boarding, quiet aircraft, and priority check-in create a smoother experience, even without lounge access or business class perks

Probably Not Worth It If You…

- Rarely (or never) fly Porter — the value of these cards is tightly tied to using Porter Airlines regularly

- Prefer flexible rewards — unlike Aeroplan or Amex Membership Rewards, VIPorter points can’t be transferred or used across multiple partners

- Would rather earn cashback or hotel points — if your travel goals are more Marriott than Montreal, this card may not align with your needs

Bottom line: These cards are great for loyal Porter flyers — especially families or East Coast travelers — but not ideal for those chasing global redemptions or flexible points currencies.

VIPorter vs. Aeroplan, WestJet, Avion & Other Travel Programs

Trying to figure out how VIPorter stacks up against other Canadian travel rewards programs? Here’s how it compares to a few of the major players.

VIPorter vs. Aeroplan:

Both programs offer similar average redemption value — around 1.5 cents per point — but Aeroplan is far more flexible. With Aeroplan, you can book across dozens of airline partners and access international routes around the world. VIPorter, on the other hand, is limited to Porter-operated flights, which means less flexibility — but often simpler, more transparent redemptions.

VIPorter vs. WestJet Rewards:

WestJet Rewards isn’t a points program — it’s dollar-based. You earn WestJet Dollars, which are easier to understand (1 WSD = $1 off travel), but often harder to stretch for outsized value. VIPorter can offer better redemption potential, especially during peak seasons or when fares are high. Porter’s status perks are also more accessible through the credit cards than WestJet’s, which typically requires frequent flying.

VIPorter vs. Avion Rewards (RBC):

Avion Rewards points are much more flexible. You can use them for travel through the RBC travel portal or transfer them to partners like British Airways Avios or American AAdvantage. That flexibility makes Avion better for travelers chasing deals or flying internationally. VIPorter, while simpler and potentially higher in fixed redemption value, lacks those transfer options — it’s great if you’re sticking to Porter routes but not ideal for globe-trotting.

VIPorter vs. Air Miles:

Air Miles can be hit or miss — the program has become more complex, and redemption values vary widely depending on what you’re booking. VIPorter is refreshingly straightforward by comparison. You earn points and redeem them for flights — no tiers, no region charts, and no guessing.

Bottom Line:

If you fly Porter regularly or live in one of their core cities, VIPorter can offer better value and a smoother user experience than many other programs. But if flexibility, international reach, or transfer partners are important to you, a program like Aeroplan, Avion, or even WestJet Rewards may be a better fit.

How I’m Earning a 15.6% Return with the BMO VIPorter World Elite

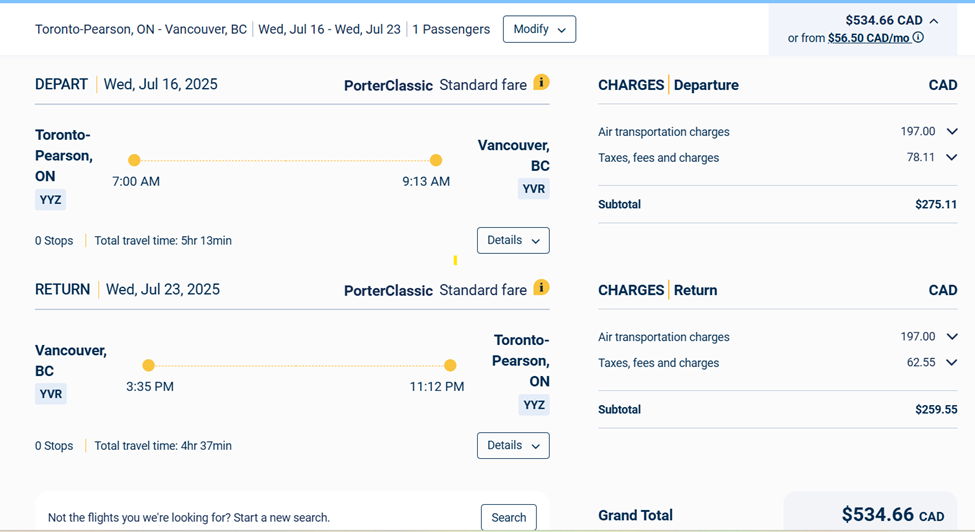

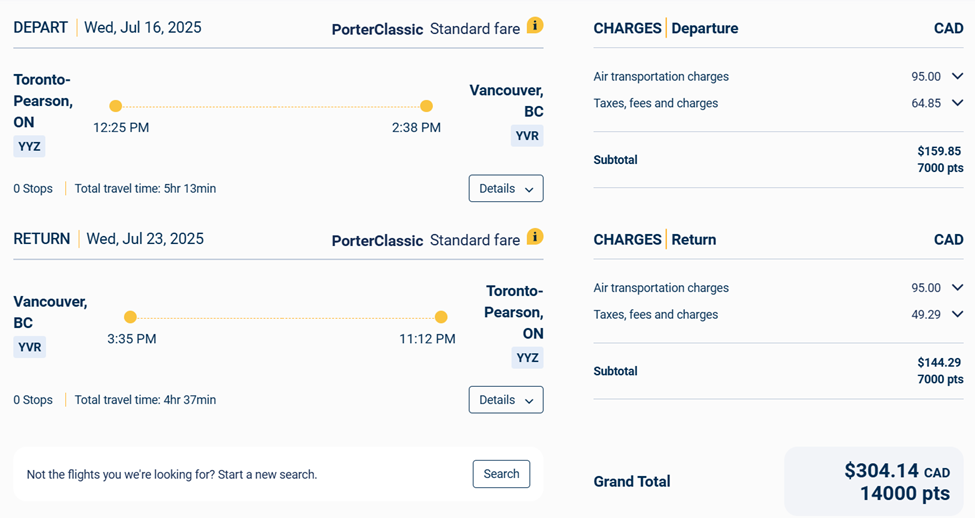

To see how much value I could actually get out of the World Elite version, I ran the numbers based on my own travel plans — a summer roundtrip from Toronto to Vancouver for a family of five. This trip in cash would be $535 per person, so $2,675 total for five people.

Here’s how the bonus points added up:

- 40,000 points from hitting the first two tiers of the signup bonus

- 10,000 points from the waitlist bonus (which I signed up for)

- 9,000 points earned from everyday spending while hitting those tiers

- Total: 59,000 points, plus a 100% base fare companion pass

For the trip itself, I can use points to cover 4 tickets, each requiring 14,000 points + $304 in taxes and fees. That came to 56,000 points + $1,216 cash. For the fifth seat, I will use the companion pass earned from the $9,000 spend, which covers the base fare, and will pay $341 in taxes and fees.

In total, we would pay $1,557 out-of-pocket for a trip that would’ve cost $2,675 if booked entirely in cash — a savings of about $1,118.

And that doesn’t even factor in the free seat selection and checked bags that come with the card, which could easily be worth another $300+ for a family of five. Altogether, I estimate the first-year value at around $1,400, which works out to a 15.6% return on $9,000 spend — with the annual fee waived in year one.

Are the BMO VIPorter Credit Cards Worth It?

If you fly Porter even once or twice a year — especially with family or a travel companion — these cards can offer solid value, particularly in the first year when the annual fee is waived.

The perks like free seat selection, checked bags, and priority boarding can easily offset the cost of the card with just a single trip. Add in a generous signup bonus and automatic VIPorter status, and it’s a strong package for anyone who regularly flies within Porter’s network.

That said, you’ll want to make sure Porter fits your travel pattern long-term. If you’re flying other airlines more often or want the flexibility to transfer points, other travel cards may be a better fit.

Best approach? Use the first year to test the card. Maximize the bonus, enjoy the perks, take the quiet flight — then decide in year two whether it’s worth keeping based on your travel habits.

Where to Apply for BMO VIPorter Credit Cards and Learn More

Interested in applying or learning more? You can find all the details on BMO’s official landing page:

Visit BMO to Learn More About VIPorter Cards

Looking for other travel card options? Check out my guide to the Best Travel Credit Cards in Canada to compare with Aeroplan, Amex, and more.

Frequently Asked Questions About BMO VIPorter Credit Cards

What are the benefits of the BMO VIPorter credit cards?

Both cards come with automatic VIPorter status, priority check-in and boarding, and a full suite of travel insurance. The World Elite version also includes free seat selection, free checked and carry-on baggage for up to 8 companions, and access to a companion flight pass after meeting an annual spend threshold.

How much are VIPorter points worth?

VIPorter points are generally worth around 1.5 cents per point when redeemed for Porter-operated flights. This is comparable to the value you’d get from Aeroplan points, but without transfer flexibility.

Do VIPorter points expire?

No — as long as you hold either the BMO VIPorter Mastercard or World Elite Mastercard, your VIPorter points do not expire. This is a big plus for occasional travelers who may not fly Porter every year.

Do you get free baggage with the VIPorter credit cards?

Yes — but only with the World Elite version. You’ll receive complimentary checked and carry-on baggage for yourself and up to 8 people on the same reservation. The base card does not include this benefit.

Can I redeem VIPorter points on other airlines like Alaska?

Not at this time. VIPorter points can only be used on Porter-operated flights. While Porter partners with Alaska Airlines for connecting routes, you cannot use points to book flights on Alaska or other partner airlines.

Is the BMO VIPorter World Elite worth it over the base card?

It depends on how often you fly Porter and whether you’ll use the added perks like free bags and seat selection. For families or frequent Porter flyers, the World Elite can offer significantly more value — especially in the first year with the annual fee waived.

BMO VIPorter Mastercard

BMO VIPorter Mastercard BMO VIPorter World Elite

BMO VIPorter World Elite