The Amex Bonvoy personal and business credit cards are some of the best for discounted hotel stays in Canada. Whether you travel occasionally or frequently, these cards help you score hotel stays at a fraction of the price. My player two and I have held these cards for a few years now, and we have been easily getting hotel stays worth significantly more than the annual fees of the cards. Let’s break down how they work, why they’re worth holding, and how you can maximize their benefits.

- Best offer is through a referral link like the one below

- Instant Silver Elite Status

- Spend $3,000 in 3 months → Earn 65,000 points (ends August 18, 2025)

- Free night certificate every year up to 35,000 points starting on the first anniversary (~$350 value)

- Annual fee: $120

- Apply Here

- Best offer is through a referral link like the one below

- Instant Silver Elite Status

- Spend $6,000 in 3 months → Earn 75,000 points (ends August 18, 2025)

- Free night certificate every year up to 35,000 points starting on the first anniversary (~$350 value)

- Annual fee: $150

- Apply Here

Why the Amex Bonvoy Cards Are Worth It

Related: The Complete Beginner’s Guide to Marriott Bonvoy

Free Night Certificate: The Ultimate Perk

One of the most valuable perks of these cards is the Free Night Certificate worth 35,000 Marriott Bonvoy points. This certificate is awarded every year on your card anniversary and can be redeemed for rooms that typically cost $350+ per night, with redemptions sometimes exceeding $500 in value.

- Annual Fee vs. Discounted Night Value

- Personal Bonvoy Card: $120 annual fee

- Business Bonvoy Card: $150 annual fee

- Free Night Certificate Value: 35,000 points worth ~$350

- Net Savings: $200+ in travel value every year

Signup Bonus: Instant Bonvoy Points Value (Elevated Offer ends August 18, 2025)

Although you won’t receive your discounted night certificate until your first anniversary and you do have to pay the annual fee upon sign-up ($120 for the personal card, $150 for the business card), the welcome bonus alone makes up for it. Upon meeting the spending requirement, you’ll earn 65,000 – 60,000 Bonvoy points, which translates to $500 – $600 in hotel stays.

- Spending Requirements

- Personal Bonvoy Card: Spend $3,000 in 3 months for 65,000 points, earn 15,000 points by spending anything in months 15-17

- Business Bonvoy Card: Spend $6,000 in 3 months for 75,000 points, earn 15,000 points by spending anything in months 15-17

Technically, there is a way to earn 30,000 points on $20,000 spend for the personal card, or 40,000 points on $30,000 spend, but feel free to skip that requirement. Even if you were a big spender, the points return % on that amount of spend is not worth it.

💡 Tip: To meet the spending requirements, charge everything possible to the card, including:

- Groceries, dining, and transportation

- Utility and phone bills

- Property taxes

- Insurance payments

Earn Marriott Bonvoy Points on Everyday Spending

Beyond the welcome bonus, these cards earn Bonvoy points on every dollar spent, making it easier to accumulate points for future redemptions.

- Both Cards:

✅ 5X points on Marriott Bonvoy purchases (hotel stays, dining at Marriott properties, etc.)

✅ 2X points on everything else - Business Bonvoy Card Exclusive Perks:

✅ 3X points on gas, dining, and travel

Using the Free Night Certificate + Points

Rather than using Bonvoy points alone for hotel redemptions, you can top up your discounted night certificate with up to 15,000 additional points to unlock stays worth up to 50,000 points. This provides more flexibility and allows you to book premium properties at a lower out-of-pocket cost.

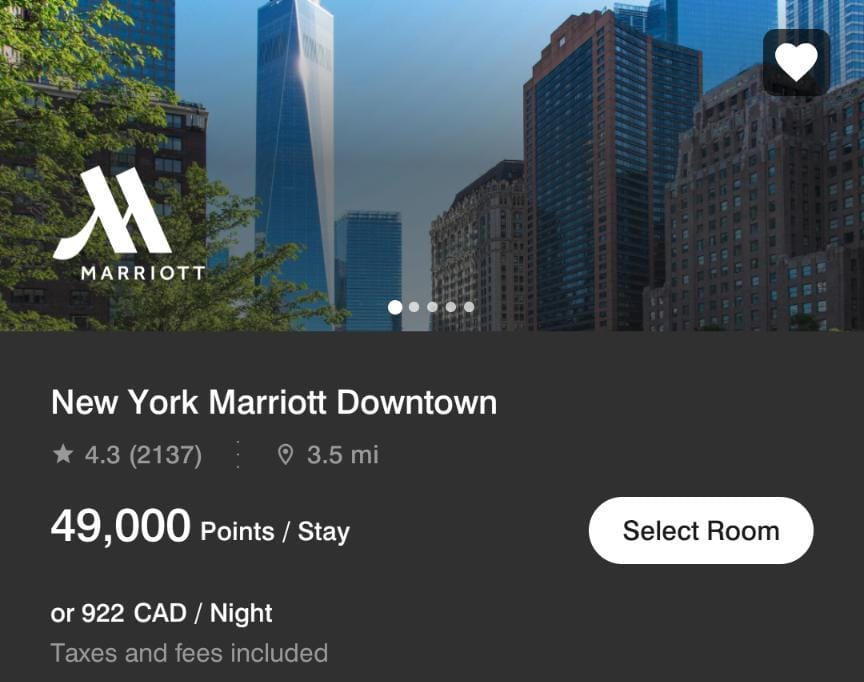

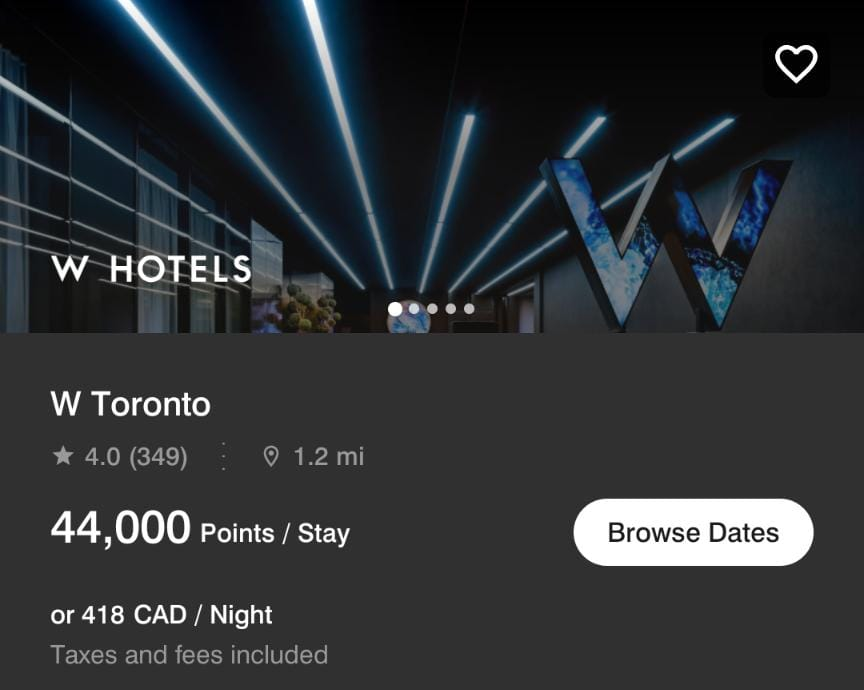

Example Marriott Bonvoy Redemptions:

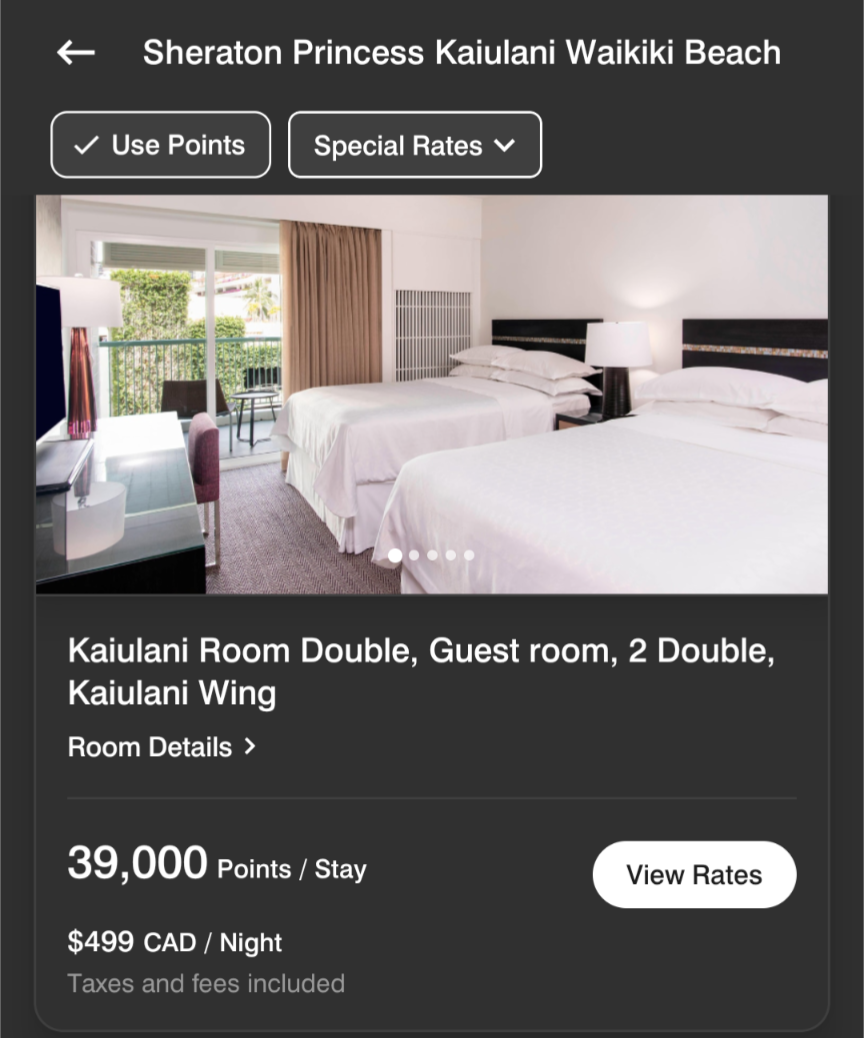

- 35,000 Points → Standard Marriott properties like Westin, Sheraton, or Autograph Collection hotels

- 50,000 Points (Discounted Night + 15k top-up) → Higher-end properties like JW Marriott, W Hotels, or St. Regis in select cities

Amex Bonvoy Cards Save You Big on Hotels Year After Year

Suppose you won’t redeem points in the first year and save them for top ups, the earn value starts at $0. Starting from Year 2, we assume you redeem the 35,000-point certificate and top up with 10,000 points for a total redemption worth $450 per night, which is conservative. Often, you can find even more value.

1 Free Night Every Year with One Amex Bonvoy card

By holding just the Amex Bonvoy card, starting in the 2nd year, every year you’d potentially be receiving $450 of value (35,000 free night certificate + 10,000 points top up) in a hotel night redemption for the $120 annual fee.

| Year | Annual Fee ($) | Discounted Night Value ($) | Net Value ($) |

| 1 | 120 | 0 | -120 |

| 2 | 120 | 450 | +330 |

| 3 | 120 | 450 | +330 |

| 4 | 120 | 450 | +330 |

| 5 | 120 | 450 | +330 |

Double Up: Get 2 Free Nights with Both Amex Bonvoy Cards

Holding both the personal and business card versions, assuming a 10,000 point top-up on both free night certificates, you would be potentially receiving $900 of value for $270 every year, starting in the 2nd year.

| Year | Annual Fees ($) | Discounted Nights Value ($) | Net Value ($) |

| 1 | 270 | 0 | -270 |

| 2 | 270 | 900 | +630 |

| 3 | 270 | 900 | +630 |

| 4 | 270 | 900 | +630 |

| 5 | 270 | 900 | +630 |

Couples Strategy: Earn 4 Free Marriott Nights Every Year with Amex Bonvoy Cards

If you and your travel partner each hold both the personal and business versions, starting in the 2nd year, you would be potentially be receiving 4 nights of hotel rooms worth $1800 while paying $540 every year. An effective savings of 70%.

| Year | Annual Fees (P1 + P2) ($) | Discounted Nights Value ($) | Net Value ($) |

| 1 | 540 | 0 | -540 |

| 2 | 540 | 1800 | +1260 |

| 3 | 540 | 1800 | +1260 |

| 4 | 540 | 1800 | +1260 |

A Low-Cost, Flexible Way to Lock in Discounted Hotel Stays Every Year

This strategy works a lot like a timeshare, where you pay a small yearly fee in exchange for hotel stays with much more than the fee. The difference? It’s way more flexible, far less expensive, and you can cancel the card at anytime.

- Every year, you pay a fixed fee ($120-$150 per card) but receive discounted stays worth much more.

- Instead of being locked into a single resort, you can use your discounted nights at thousands of Marriott properties worldwide.

- No huge upfront investment—just an annual fee that instantly pays for itself in hotel savings.

- If you ever decide you don’t need it anymore, just cancel the card—no contracts, no hassle.

It’s an easy, low-cost way to secure luxury hotel stays year after year, without the financial burden or restrictions of a traditional vacation program.

Is This Strategy Right for You?

If you travel at least once a year and would benefit from a discounted hotel stay, then these cards are an easy way to save money and stay in premium properties at a fraction of the cost.

However, if you don’t see yourself needing a hotel stay annually, then these cards may not be the best fit for you. The value of the free night certificate is only useful if you actually use it—otherwise, you’re just paying an annual fee without getting anything in return.

That said, if you think you might use it but aren’t sure, consider getting the card for the first-year signup bonus, which alone provides $500-$600 in value, and then reassess after the first year whether to keep it.

Final Thoughts: Are These Cards Worth It?

In my opinion, absolutely. The Amex Bonvoy cards provide an fantastic return on investment, even for casual travelers. By leveraging the signup bonuses, discounted night certificates, and top-up option, you can easily extract more value than you pay in fees.

💡 Key Takeaways:

The discounted night certificates alone justify the annual fees

The signup bonuses cover the first year’s fee and more

Holding both cards doubles your travel benefits

Player Two strategy unlocks even more value for couples/families

You can top up certificates to unlock higher-value stays

Ready to Start?

🚀 Apply for the Amex Bonvoy Personal or Business Cards and start stacking up discounted hotel nights today! Have questions? DM me on IG!

Note: The links to apply are my referral links, which often provide a higher signup bonus than the public offer. If you apply through my link, you’ll get more points, and I’ll receive a referral bonus as well.